Exploring the Impact of China Stake Formation in Investment Rounds and Market Dynamics

Understanding the China Stake Form Round A Key to Investment Strategies

The dynamic landscape of investment in China has seen a transformative shift in recent years, where various forms of investment methods are being employed to enhance the strategic value of assets. Among these investment vehicles, the China Stake Form Round has emerged as a significant concept for investors seeking to capitalize on the rapidly evolving Chinese market. This article delves into what the China Stake Form Round entails, its implications for investors, and the overall impact on the investment ecosystem.

Understanding the China Stake Form Round A Key to Investment Strategies

One of the main drivers of interest in the China Stake Form Round is the promise of high returns. China's rapid economic growth, coupled with an expanding middle class, presents unparalleled opportunities for innovative startups in industries like fintech, e-commerce, AI, and biotechnology. Moreover, the Chinese government has been proactive in creating a favorable environment for startups through favorable policies and funding initiatives, making the country an attractive destination for investors looking to diversify their portfolios.

china stake form round

However, engaging in the China Stake Form Round is not without its challenges. The regulatory landscape in China can be complex and often unpredictable. For instance, the Chinese government has historically imposed various restrictions on foreign investments in certain sectors, which could raise red flags for international investors looking to participate in these funding rounds. Understanding and navigating the nuances of the regulatory environment is crucial for success in leveraging the China Stake Form Round.

Moreover, investors need to conduct thorough due diligence during the investment process. This involves evaluating the company's business model, market potential, competitive landscape, and financial health. The stakes are high, and making informed decisions is essential to mitigate risks and enhance the likelihood of a successful investment outcome.

For startups, concluding a successful China Stake Form Round can serve as a validation of their business model and growth potential. It not only provides essential capital to fuel expansion but also enhances visibility and credibility in the market. Securing funding from reputable investors can improve a company's standing and attract additional partnerships and opportunities.

In conclusion, the China Stake Form Round represents a pivotal moment in the investment lifecycle that can yield significant benefits for both investors and startups. For investors, it offers a pathway to engage with one of the world's most robust markets, while for startups, it provides the necessary resources to scale and innovate. However, success in this arena requires a deep understanding of the unique market dynamics, regulatory conditions, and the importance of structured negotiations. As the landscape continues to evolve, the China Stake Form Round will likely play an increasingly critical role in shaping the future of investment in China, influencing both domestic and global investment strategies.

-

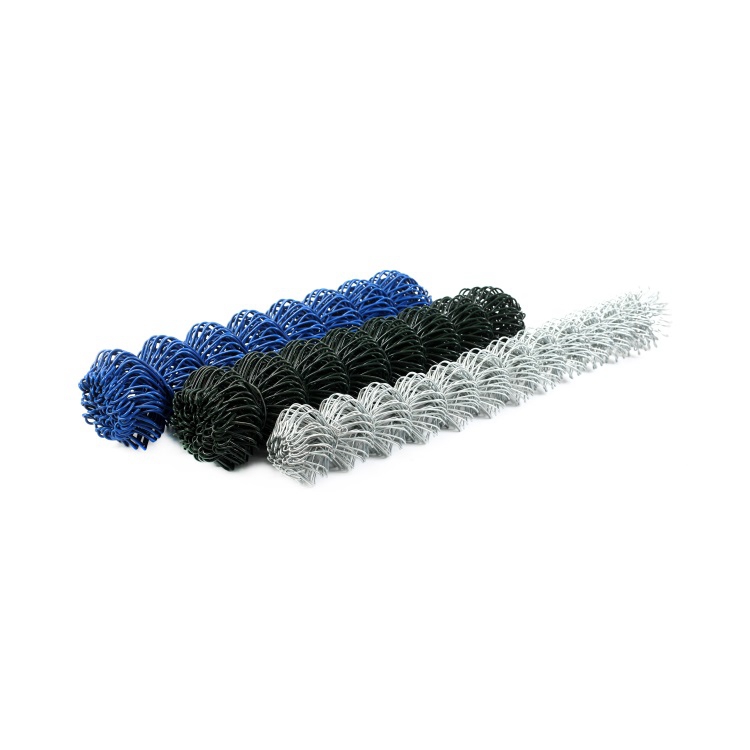

The Ultimate Guide to Premium Quality Field Fence Solutions

NewsAug.12,2025

-

The Essential Guide to Premium Square Wire Mesh Solutions

NewsAug.12,2025

-

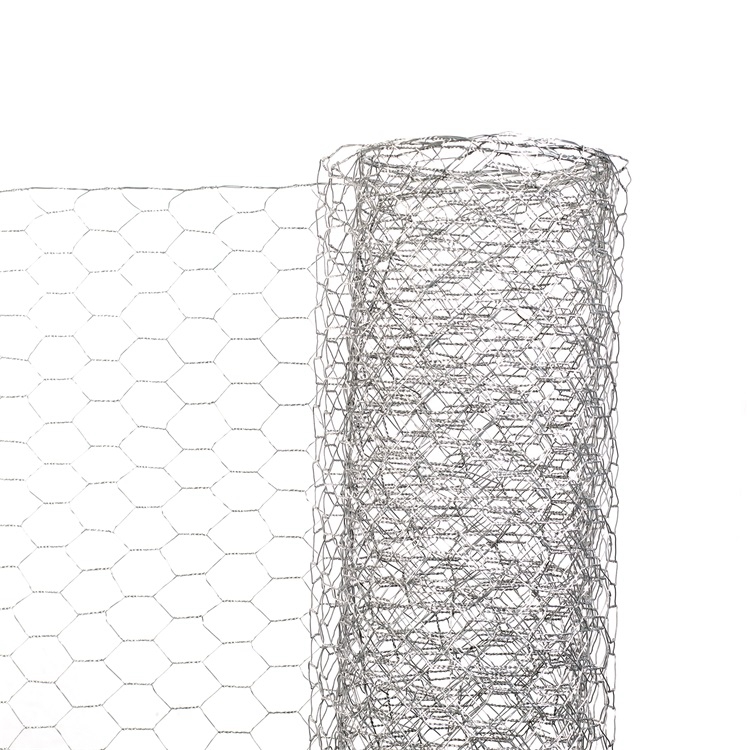

The Essential Guide to Hexagonal Wire Netting Farm Fencing

NewsAug.12,2025

-

Premium Continuous Deck Rail Slab Bolster Solutions

NewsAug.12,2025

-

High-Performance Aluminum Tie Wire Reel for Construction Applications

NewsAug.12,2025

-

Crafted Premium Galvanized Hexagonal Gabion Wire Mesh Solutions

NewsAug.12,2025