Exploring the Impact of a 3/4 Stake in a Manufacturing Business on Growth Strategies

The Implications of Acquiring a 3/4 Stake in a Manufacturing Facility

In the competitive landscape of modern industry, strategic investments play a crucial role in maintaining a competitive edge. One such strategy is acquiring a significant stake in a manufacturing facility—in this case, a 3/4 stake—which can bring both opportunities and challenges for businesses. This article explores the implications of such an investment, focusing on operational control, financial benefits, and strategic alignment.

The Implications of Acquiring a 3/4 Stake in a Manufacturing Facility

Financially, owning three-quarters of a manufacturing facility can be extremely beneficial. The majority stake enables the company to gain a larger share of the profits generated by the factory. This can result in higher returns on investment, especially if the factory is well-positioned in a growing market. Moreover, the controlling company can leverage the factory's assets to secure financing for expansion or other projects, enhancing overall financial stability and growth potential. Furthermore, cost savings achieved through operational improvements can directly contribute to the bottom line, enabling reinvestment into other areas of the business or into the factory itself.

3/4 stake factory

Strategic alignment is another significant benefit of acquiring a 3/4 stake in a factory. A closer integration between the manufacturing facility and the parent company allows for better alignment of goals and objectives. This can lead to increased innovation, as the parent company can directly influence the product development process, ensuring that the factory's output aligns with market demands. Additionally, being closely involved in the manufacturing process allows for more agile responses to market changes, as decisions can be made swiftly and efficiently without the need for prolonged negotiations with minority stakeholders.

However, owning a 3/4 stake in a factory is not without its challenges. One of the primary concerns is the responsibility that comes with majority ownership. The controlling company is accountable for the factory’s performance and must manage both operational and financial risks effectively. This requires a deep understanding of the manufacturing processes and the industry landscape. Additionally, majority ownership could potentially lead to conflicts with minority stakeholders, especially if their interests differ from those of the majority. Effective communication and relationship management become essential to mitigate such issues and ensure a smooth operating environment.

Moreover, with greater control comes greater scrutiny. Regulatory bodies may impose stricter requirements and oversight on a majority-owned facility. Compliance with environmental, health, and safety regulations becomes paramount, demanding ongoing investment in training and ensuring that the facility meets all applicable standards.

In conclusion, acquiring a 3/4 stake in a manufacturing facility can provide significant competitive advantages, including enhanced operational control, increased financial returns, and better strategic alignment. However, it also presents challenges and responsibilities that require careful management. Companies considering such investments must weigh the potential benefits against the risks and ensure they have the necessary resources and expertise to optimize the factory’s performance while navigating the complexities of ownership. This strategic move, when executed effectively, can indeed lead to substantial growth and market leadership in an ever-evolving industrial landscape.

-

Types and Uses of Common Nails in Construction

NewsJul.31,2025

-

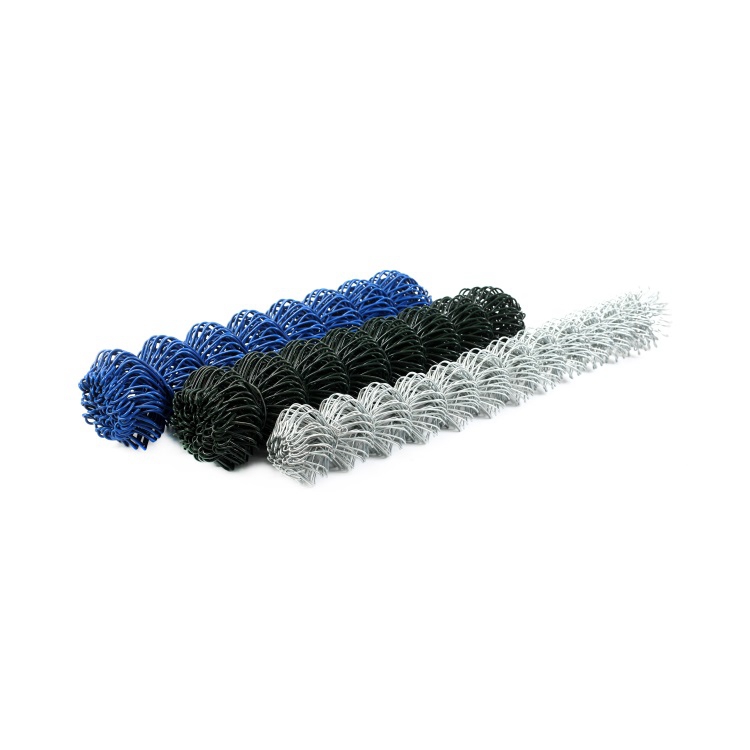

The Transformative Role of Square Wire Mesh in Contemporary Architecture

NewsJul.31,2025

-

The Essential Role of Razor Wire in Modern Perimeter Security

NewsJul.31,2025

-

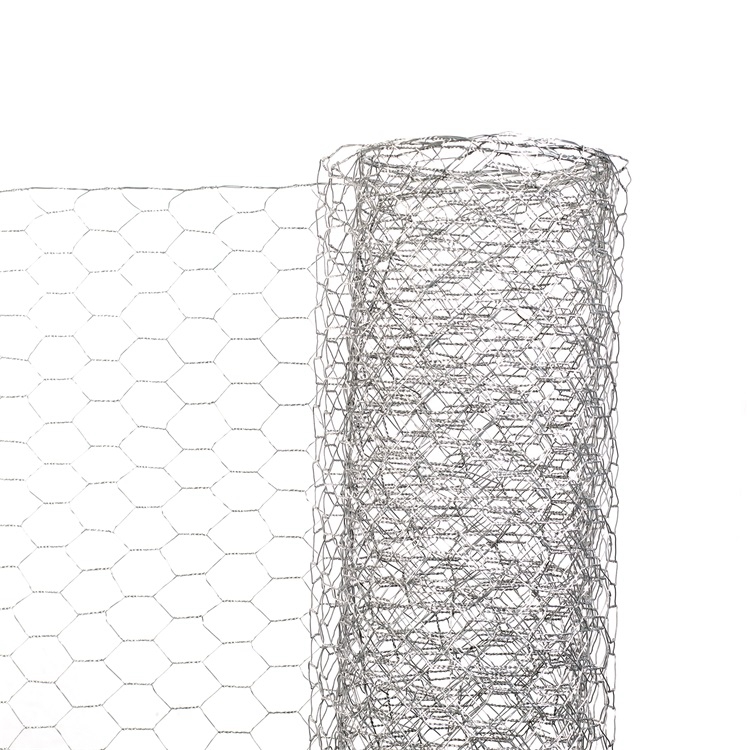

Installation Guide for Hexagonal Wire Netting Fencing

NewsJul.31,2025

-

How to Properly Use Rebar Wire Ties for Stronger Concrete Structures

NewsJul.31,2025

-

Creative and Decorative Uses of Barbed Wire in Design

NewsJul.31,2025