China's T Post Emerges as a Trendsetter in Fashion and Culture

Exploring the Influence of China’s T-post Financial Technology

In recent years, the rapid evolution of financial technology (FinTech) in China has significantly transformed how individuals and businesses engage with financial services. Among the various innovative platforms that have emerged, China’s T-post has become a noteworthy player. This article delves into the implications of T-post for China’s financial landscape and its broader impact on global FinTech trends.

Exploring the Influence of China’s T-post Financial Technology

One of the major advantages of T-post is its ability to democratize access to financial services. Historically, many individuals in China, particularly in rural areas, faced challenges in accessing banking services due to geographical and infrastructural barriers. T-post leverages mobile technology, allowing users to perform transactions, manage investments, and access credit from the comfort of their smartphones. This shift has resulted in increased financial inclusion, enabling millions to participate in the economy who were previously excluded.

china t post ft

Moreover, T-post exemplifies the power of data in driving financial decision-making. Leveraging big data analytics, the platform can assess user behavior and preferences, allowing for tailored financial products that meet specific needs. This personalized approach not only enhances customer satisfaction but also fosters loyalty among users. The ability to offer customized financial solutions has set T-post apart from traditional banks, which often struggle with inflexible offerings.

The rise of T-post has also facilitated a culture of innovation within China's FinTech sector. As more startups and tech companies enter the market, there is a continuous push for new ideas and solutions that enhance financial services. This competitive environment has led to advancements in areas such as blockchain technology, digital currencies, and artificial intelligence-driven financial advising. As a result, China is not only at the forefront of adopting innovative financial technologies but is also influencing global trends in the FinTech space.

However, the growing prominence of T-post and similar platforms raises important regulatory considerations. The integration of financial services and social media can lead to challenges in consumer protection, cybersecurity, and data privacy. The Chinese government has recognized these risks and has taken steps to establish regulations that promote safe digital transactions while encouraging innovation. Striking a balance between fostering growth and ensuring security will be crucial as T-post evolves.

In conclusion, China’s T-post represents a significant shift in the financial technological landscape, driven by the burgeoning integration of social media and finance. With its focus on financial inclusion, personalized services, and innovation, T-post is not only reshaping how Chinese consumers interact with financial institutions but is also setting a precedent for global FinTech practices. As the world continues to embrace digital financial solutions, the lessons learned from China's experience with T-post will undoubtedly resonate across borders, offering insights into the future of finance in the digital age.

-

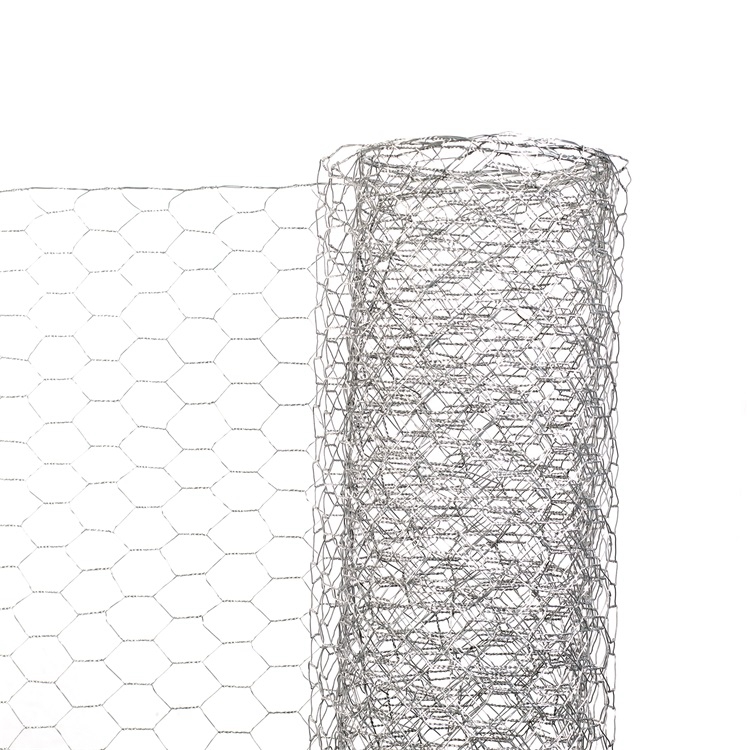

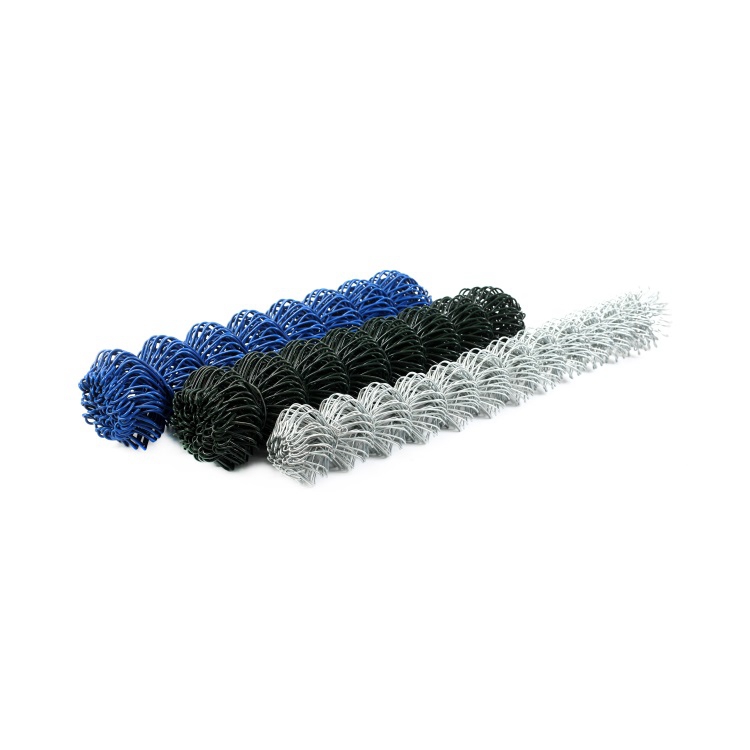

The Durability and Versatility of Steel Wire

NewsJun.26,2025

-

The Best Iron Nails for Your Construction Projects

NewsJun.26,2025

-

Strengthen Your Projects with Durable Metal Stakes

NewsJun.26,2025

-

Get the Job Done Right with Duplex Nails

NewsJun.26,2025

-

Explore the Versatility and Strength of Metal Mesh

NewsJun.26,2025

-

Enhance Your Security with Razor Wire

NewsJun.26,2025