Affordable Betting Strategies for the Savvy Gambler on a Budget

Understanding the Concept of Cheap Stake in Investment

In the world of finance, the term cheap stake often refers to investments that require a lower initial capital outlay compared to their potential returns. This concept has gained significant traction among both novice and seasoned investors who are looking to maximize their portfolios while minimizing risks. The allure of finding undervalued assets or shares that are available at a discount plays a crucial role in the investment strategies of many individuals and institutions alike.

Understanding the Concept of Cheap Stake in Investment

One of the most compelling advantages of pursuing cheap stakes is the potential for high returns. When an investor buys shares in a distressed company or an economic sector that is temporarily out of favor, they may position themselves to benefit immensely if the market reacts positively in the future. For instance, industries like renewable energy, technology, and biotechnology often experience cycles of boom and bust. By acquiring stakes in these sectors at the right time, investors can realize profits that far outstrip their initial investments.

cheap stake post

However, it's important to approach cheap stake investments with caution. While the potential for high returns is attractive, it is equally crucial to assess the risks involved. Cheap assets may remain undervalued for extended periods, or worse, they could continue to decline in value if the underlying issues are not resolved. Conducting a robust fundamental analysis is necessary, including examining a company's financial health, market potential, and competitive position. Investors must also remain aware of broader economic indicators that could impact their investment decisions.

Moreover, diversification is vital when pursuing cheap stakes. By spreading investments across various sectors and asset classes, investors can mitigate risks associated with any one particular investment. A diversified portfolio can provide a buffer against potential losses, allowing for more stable returns over time. This strategy is particularly useful in volatile markets where individual stocks may experience significant fluctuations.

In recent years, the advent of technology and accessible financial tools has made it easier for investors to identify opportunities for cheap stakes. Online platforms provide a wealth of information, including stock screeners, financial news, and data analytics, which can aid in the decision-making process. Additionally, social media and investment forums allow for real-time discussions about market trends and investment ideas, enabling individuals to make more informed choices.

In conclusion, while the pursuit of cheap stakes can be an enticing approach to investing, it necessitates a balanced consideration of both potential rewards and associated risks. Investors should equip themselves with knowledge, conduct thorough research, and remain vigilant in their strategies. By building a diversified portfolio and being patient, one can effectively leverage cheap stake opportunities to achieve long-term financial goals.

-

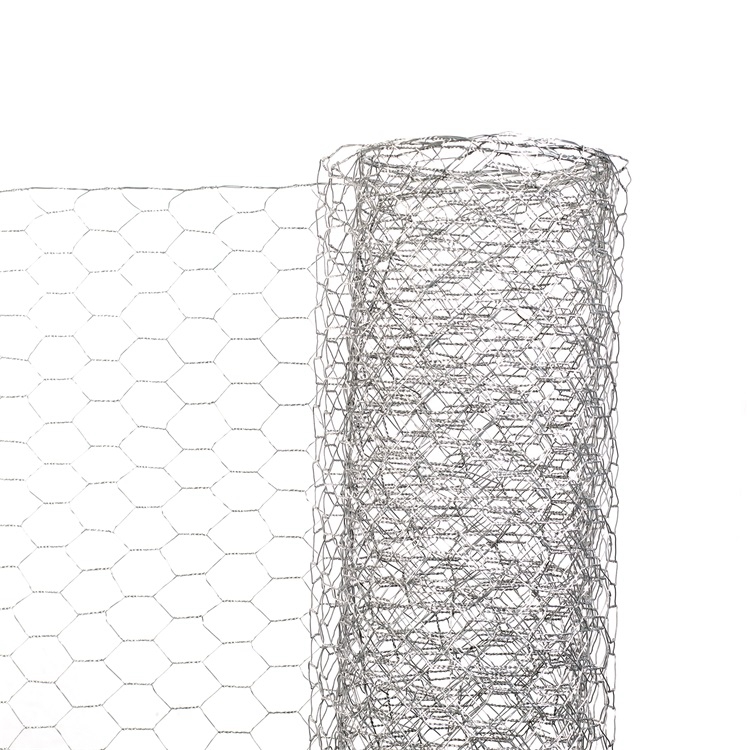

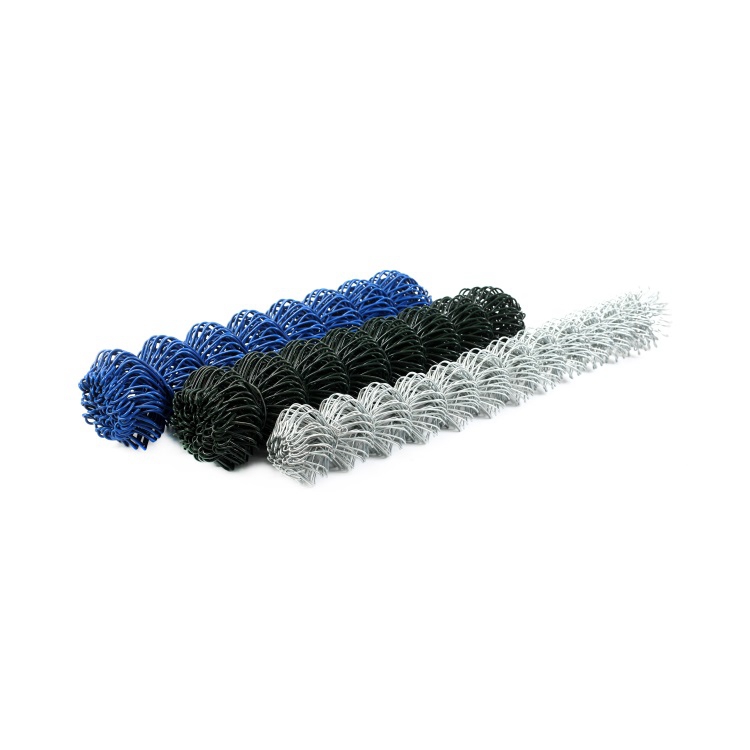

The Durability and Versatility of Steel Wire

NewsJun.26,2025

-

The Best Iron Nails for Your Construction Projects

NewsJun.26,2025

-

Strengthen Your Projects with Durable Metal Stakes

NewsJun.26,2025

-

Get the Job Done Right with Duplex Nails

NewsJun.26,2025

-

Explore the Versatility and Strength of Metal Mesh

NewsJun.26,2025

-

Enhance Your Security with Razor Wire

NewsJun.26,2025