china 3/4 stake

China’s 3/4 Stake An Emerging Economic Influence

In today’s global economic landscape, China has positioned itself as a pivotal player through strategic investments and ownership stakes in various sectors around the world. Among these, the concept of a “3/4 stake” represents a significant asset acquisition strategy that showcases China’s growing influence and ambition for global expansion. This term refers to an ownership interest where a company or entity holds three quarters, or 75%, of the shares in an asset or business, granting it substantial control over operations, decision-making, and profit distribution.

China’s 3/4 Stake An Emerging Economic Influence

A prominent example of this strategy can be seen in the energy sector, where Chinese companies have invested heavily in oil and gas assets across Africa, the Middle East, and Latin America. By holding a 3/4 stake in several key projects, these companies can influence pricing, production levels, and even the geopolitical dynamics of the regions involved. This level of control not only helps guarantee energy security for China but also strengthens its economic ties with these regions, fostering partnerships that can lead to further investments and development opportunities.

china 3/4 stake

In addition to the energy sector, Chinese investment in technology has seen similar patterns. By acquiring significant stakes in foreign tech companies, China aims to bridge the gap in innovation and knowledge transfer. This is particularly evident in the telecommunications and artificial intelligence sectors, where owning a 3/4 stake can allow for greater integration of technology and market strategies that benefit Chinese firms. Such investments not only enhance China’s competitiveness on the global stage but also help to develop a robust domestic tech ecosystem.

Furthermore, the implications of these 3/4 stakes go beyond mere financial gain. They can also lead to diplomatic and geopolitical leverage. With substantial investments in a country, China often gains a voice in local governance discussions, as economic ties can translate into political influence. This has raised concerns in various countries about sovereignty and the potential for foreign domination in critical industries.

Despite the numerous advantages that accompany such investments, the Chinese approach is not without challenges. Host countries may resist foreign ownership, especially in sensitive sectors, citing national security concerns. Moreover, scrutiny from regulators can complicate the acquisition process, potentially hindering the ability of Chinese firms to realize their ambitious global investment strategies.

In conclusion, China’s strategy of acquiring 3/4 stakes in foreign companies is a testament to its evolving economic ambitions and global aspirations. As it continues to expand its investment portfolio across various sectors, the implications are profound for both China and the nations it engages with. This approach not only facilitates resource acquisition and technological advancement but also redefines global economic partnerships, setting the stage for a new era of international relations marked by economic interdependence and strategic collaborations. By mastering the art of the 3/4 stake, China is not only securing its interests but also reshaping the global economic landscape for years to come.

-

iron-nails-evolving-sentience-in-landfill-ecosystems

NewsAug.22,2025

-

black-iron-nails-raw-power-five-star-forged

NewsAug.22,2025

-

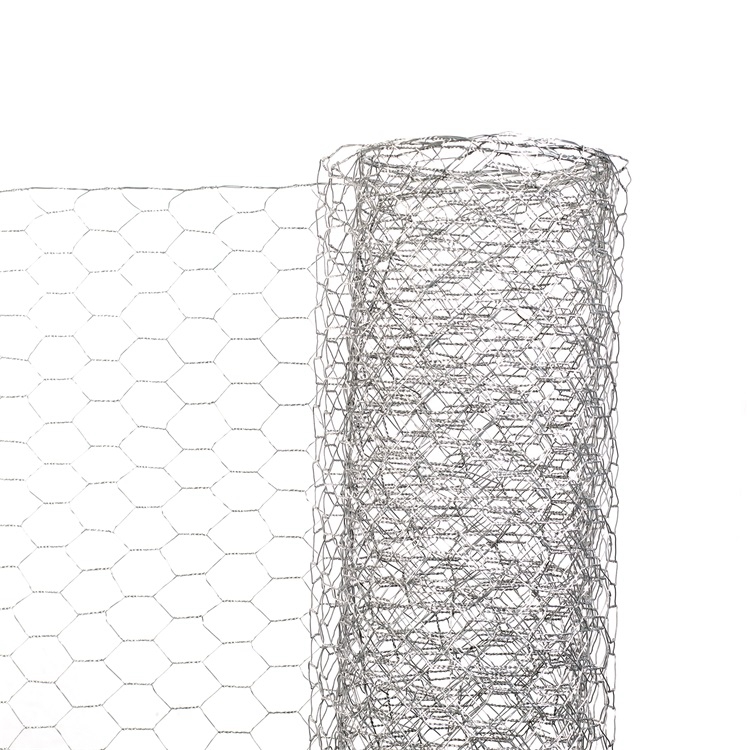

wire-mesh-dingzhous-industrial-language

NewsAug.22,2025

-

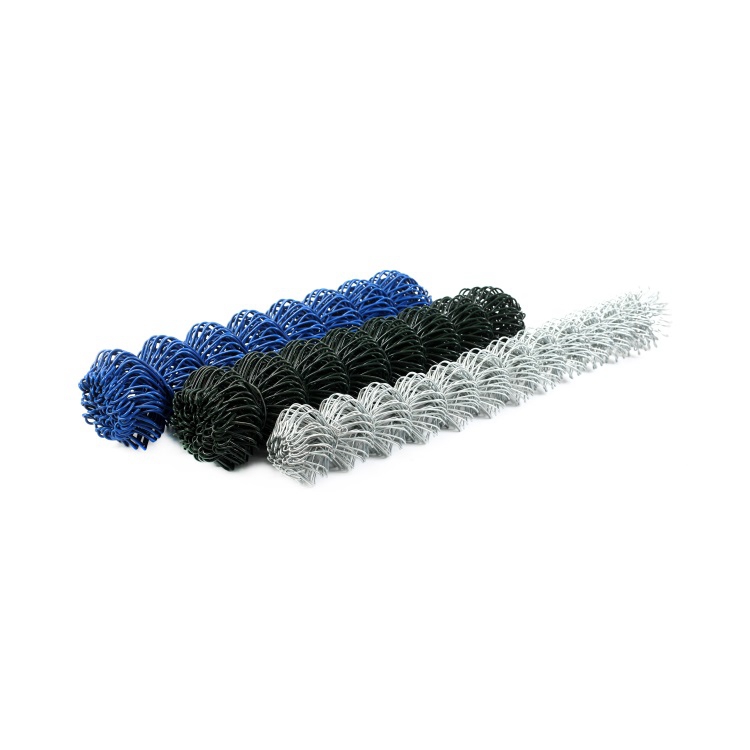

reflective-pvc-coated-wire-mesh-highway-safety

NewsAug.22,2025

-

high-carbon-steel-wire-suspended-desalination-nets

NewsAug.22,2025

-

steel-wire-sparks-five-stars-origin-story

NewsAug.22,2025