Strategies for Maximizing Stakeholder Engagement Through Discount Offers and Promotions

Understanding Discount Stake Post A Comprehensive Overview

In the ever-evolving realms of finance and investments, terms and concepts often emerge that capture the attention of investors and analysts alike. One such topic gaining traction is discount stake post. While it may sound like a niche term, it encapsulates significant implications for both individual investors and corporations. This article delves into the meaning, relevance, and potential applications of discount stake post in today's financial landscape.

To begin, it’s essential to clarify what a discount stake refers to. Generally, in financial terms, a stake is an ownership position in a company, often represented by shares of stock. A discount stake is essentially a shareholding that is acquired at a price lower than its perceived market value. This scenario can occur for various reasons, including strategic corporate moves such as ventures into mergers and acquisitions or distressed sales where a seller must liquidate assets quickly.

The term post in this context typically refers to the status of the stake after a certain transaction or event has occurred. For example, in a merger or acquisition scenario, a company may acquire a discount stake as part of a larger corporate strategy, post-transaction. This post-acquisition state becomes pivotal as it reframes the company’s valuation and prospects for future growth.

discount stake post

One of the critical motivations for pursuing discount stakes post-acquisition is the potential for substantial returns. Investors and companies that acquire stakes at a discount can position themselves for significant appreciation if the market corrects itself and the value of the shares rises to reflect their intrinsic worth. Moreover, it can serve as a strategic maneuver to gain control or influence within a company, allowing the stakeholder to engage more actively in governance and operational decisions.

From a broader perspective, discount stakes can be beneficial during economic downturns or periods of volatility when quality companies might be undervalued. Savvy investors can capitalize on these opportunities by identifying potential bargains. However, it is crucial to conduct thorough due diligence before making any investment decisions in this area. Understanding the underlying reasons for the discount, the company’s financial health, and the market conditions can make a significant difference between a lucrative venture and a financial pitfall.

Moreover, the discount stake post becomes a topic of significant interest for stakeholders who focus on corporate governance. Entities that hold discount stakes often aim to influence the strategic direction of a company. This influence can lead to changes in management decisions, company policies, or even potential buyouts. Consequently, this dynamic can stir debates around shareholder rights and corporate governance, especially if the strategies pursued by the discount stake holder don’t align with the interests of other shareholders.

In conclusion, the concept of discount stake post holds considerable importance in today's investment environment. It reflects a strategy that can yield significant rewards when approached with knowledge and careful analysis. As investors navigate the complexities of the stock market, understanding the nuances behind discount stakes, especially in a post-transaction context, can empower them to make informed decisions. Additionally, it highlights the intricate interplay between market dynamics, corporate strategy, and stakeholder engagement, demonstrating that being a proactive investor is not just about buying low and selling high, but also about being aware of the valuation landscape and potential future movements. By leveraging this understanding, investors can position themselves to not only weather market storms but thrive in periods of uncertainty.

-

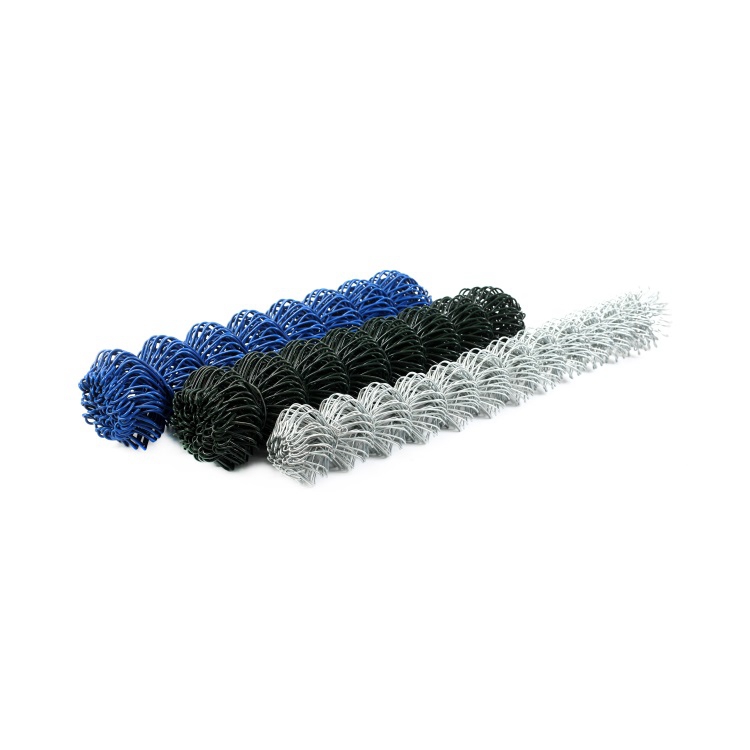

The Ultimate Guide to Premium Quality Field Fence Solutions

NewsAug.12,2025

-

The Essential Guide to Premium Square Wire Mesh Solutions

NewsAug.12,2025

-

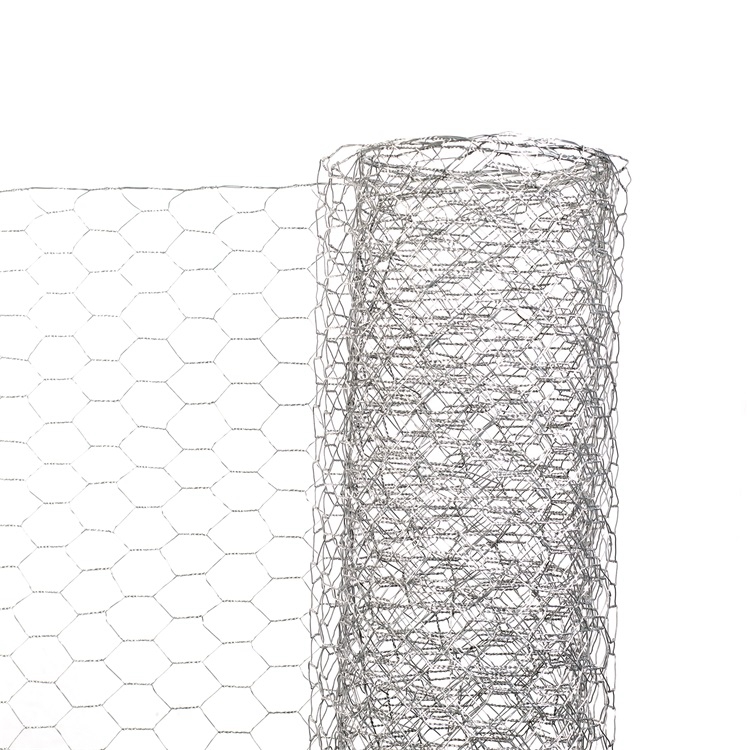

The Essential Guide to Hexagonal Wire Netting Farm Fencing

NewsAug.12,2025

-

Premium Continuous Deck Rail Slab Bolster Solutions

NewsAug.12,2025

-

High-Performance Aluminum Tie Wire Reel for Construction Applications

NewsAug.12,2025

-

Crafted Premium Galvanized Hexagonal Gabion Wire Mesh Solutions

NewsAug.12,2025